Starting off with Auto Policy Quotes: Tracking Renewal Price Changes in India, this introduction aims to pique the readers' interest and provide a brief overview of the topic in a captivating manner.

The following paragraph will delve into the specifics and details of the topic at hand.

Overview of Auto Policy Quotes in India

Tracking renewal price changes for auto policy quotes in India is crucial for car owners to stay informed about the evolving insurance landscape. By monitoring these price fluctuations, individuals can make informed decisions about their coverage and premiums.

Factors Influencing Auto Policy Quotes

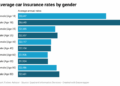

- Risk factors associated with the driver, such as age, driving experience, and history of accidents.

- Type of vehicle being insured, including its make, model, age, and safety features.

- Location of the insured individual, as areas with higher crime rates or traffic congestion may lead to higher premiums.

- Insurance company policies and underwriting guidelines, which can vary based on market conditions and competition.

Importance of Monitoring Price Changes

Keeping track of renewal price changes allows policyholders to identify potential savings opportunities, compare different insurance providers, and ensure that they are getting the best value for their money. It also helps in staying updated with any new offerings or discounts that may benefit them.

Methods for Tracking Renewal Price Changes

Insurance companies regularly adjust policy prices based on various factors. Tracking these renewal price changes is essential for policyholders to ensure they are getting the best deal.

Comparing Different Strategies

- Manual Comparison: Some policyholders manually compare renewal quotes from different insurance companies to find the best price.

- Online Comparison Tools: Many websites offer online tools that allow policyholders to compare renewal prices from multiple insurers quickly and easily.

- Broker Assistance: Insurance brokers can assist policyholders in comparing renewal prices and finding the most cost-effective policy.

Role of Technology

Technology plays a crucial role in monitoring auto policy quotes. Insurtech companies use advanced algorithms and data analytics to track renewal price changes in real-time. This technology allows policyholders to receive instant alerts when there are price fluctuations, enabling them to make informed decisions about their insurance coverage.

Impact of Market Trends on Auto Policy Quotes

Market trends play a crucial role in determining renewal price changes for auto policy quotes in India. Understanding how these trends influence pricing can help policyholders make informed decisions and adapt to market fluctuations effectively.Recent market trends have had a significant impact on auto policy quotes in India.

For example, the rise in demand for electric vehicles has led to insurance companies offering specialized policies for these vehicles, which may come with different pricing structures compared to traditional gasoline-powered cars. Additionally, changes in government regulations, such as the implementation of new safety standards or emission norms, can also affect policy pricing.To adapt to market fluctuations, policyholders can consider strategies such as regularly comparing quotes from different insurance providers, taking advantage of discounts or loyalty programs, and adjusting coverage levels based on changing market conditions.

Staying informed about industry developments and seeking advice from insurance experts can also help policyholders navigate the impact of market trends on auto policy quotes effectively.

Consumer Perspective on Auto Policy Quotes

When it comes to auto policy quotes, consumers often have common concerns about renewal price changes. These concerns can include uncertainty about how price variations will affect their budget, confusion about the factors influencing the changes, and the fear of overpaying for coverage.

Strategies for Consumers to Get the Best Auto Policy Quotes

- Compare Multiple Quotes: It is essential for consumers to compare quotes from different insurance providers to ensure they are getting the best deal.

- Review Coverage Options: Consumers should carefully review the coverage options offered in each policy to determine if they are getting the right level of protection for their needs.

- Consider Discounts: Many insurance companies offer discounts for various factors such as safe driving history, multiple policies, or vehicle safety features. Consumers should inquire about these discounts to lower their premiums.

Tips for Consumers to Navigate Through Price Variations Effectively

- Stay Informed: Consumers should stay updated on market trends and factors affecting auto insurance prices to make informed decisions.

- Negotiate with Insurers: It is worth negotiating with insurers to see if there is room for discounts or better rates based on individual circumstances.

- Regularly Review Policies: Consumers should review their policies annually to ensure they are still getting the best coverage at a competitive price.

Last Recap

Concluding this discussion on Auto Policy Quotes: Tracking Renewal Price Changes in India, the summary will encapsulate the key points and leave the readers with some food for thought.

Common Queries

What factors influence auto policy quotes?

Factors such as driving record, vehicle type, and location can impact auto policy quotes.

How do insurance companies adjust policy prices?

Insurance companies adjust policy prices based on factors like claims history, market trends, and competition.

What are some common consumer concerns regarding renewal price changes?

Consumers often worry about sudden price hikes, lack of transparency, and difficulty in comparing quotes.

How can consumers get the best auto policy quotes?

Consumers can shop around, maintain a good driving record, and consider bundling policies to get the best auto policy quotes.