Delving into Costco Car Insurance vs Direct Online Insurers: Which Is Better for UK Consumers?, this introduction immerses readers in a unique and compelling narrative, providing an overview of the two options and the importance of car insurance for UK consumers.

It also defines the key factors that influence consumers when choosing an insurance provider.

Introduction

Costco Car Insurance and Direct Online Insurers are two popular options for UK consumers seeking car insurance coverage. While Costco Car Insurance offers a more traditional approach through its membership-based model, Direct Online Insurers provide a convenient and fast online platform for purchasing insurance.

Car insurance is a crucial aspect of owning a vehicle in the UK, as it provides financial protection in cases of accidents, theft, or damage. UK consumers must carefully consider various factors when choosing an insurance provider to ensure they have the right coverage at a competitive price.

Key Factors Considered by UK Consumers

- Cost of Premiums: One of the primary factors that UK consumers consider when choosing an insurance provider is the cost of premiums. They compare quotes from different insurers to find the most affordable option that meets their coverage needs.

- Coverage Options: Consumers look for insurance policies that offer comprehensive coverage for different risks, including third-party liability, theft, fire, and personal injury protection. The extent of coverage and additional benefits influence their decision.

- Customer Service: The quality of customer service provided by an insurance company is crucial for UK consumers. They value responsive and efficient customer support, especially during claims processing and in case of emergencies.

- Policy Features and Flexibility: Consumers look for policies that offer flexible terms and additional features, such as no-claims bonuses, breakdown assistance, and legal expenses coverage. They prefer insurers that tailor policies to their specific needs.

- Claims Process: The ease and efficiency of the claims process play a significant role in consumer satisfaction. UK consumers prefer insurers with a streamlined and straightforward claims process that ensures quick resolution.

Coverage Offered

When comparing Costco Car Insurance and Direct Online Insurers, it is essential to look at the types of coverage offered to UK consumers. Understanding the differences in coverage can help individuals make an informed decision when selecting an insurance provider.

Types of Coverage

- Costco Car Insurance: Costco offers standard coverage options such as third party only, third party fire and theft, and comprehensive coverage. These options provide varying levels of protection for drivers in the UK.

- Direct Online Insurers: Direct online insurers typically offer a wide range of coverage options, including third party only, third party fire and theft, comprehensive, and additional add-ons such as breakdown cover, legal expenses, and windscreen protection.

Unique or Specialized Coverage

- Costco Car Insurance: Costco may provide unique benefits such as discounted rates for members, enhanced customer service, and bundled insurance packages that include other types of coverage like home or travel insurance.

- Direct Online Insurers: Direct online insurers may offer specialized coverage options tailored to specific needs, such as coverage for high-performance vehicles, young drivers, or individuals with a history of driving convictions.

Importance of Comprehensive Coverage

Comprehensive coverage is crucial for UK consumers as it offers the most extensive protection for their vehicles. This type of coverage typically includes protection against theft, vandalism, natural disasters, and accidents that are not the policyholder's fault. With the high cost of vehicle repairs and replacements, having comprehensive coverage can provide peace of mind and financial security in case of unforeseen events.

Cost and Affordability

When comparing Costco Car Insurance with Direct Online Insurers in the UK, it's essential to consider the cost implications for consumers. Let's delve into the differences in cost and affordability between these two options.

Cost Breakdown

Costco Car Insurance often provides competitive rates for UK consumers, leveraging its bulk-buying power. On the other hand, Direct Online Insurers may offer more tailored and potentially cheaper options based on individual circumstances. Here is a breakdown of potential costs for different demographics or vehicle types:

- Young drivers under 25: Costco Car Insurance may offer more affordable rates due to their partnership with established insurers, while Direct Online Insurers could provide discounts for safe driving habits.

- Families with multiple vehicles: Costco Car Insurance might offer bundled discounts for insuring multiple cars, whereas Direct Online Insurers could provide lower rates for each vehicle individually.

- Luxury or high-performance vehicles: Direct Online Insurers might have specialized policies for these types of vehicles, offering competitive rates, while Costco Car Insurance could provide comprehensive coverage at a reasonable cost.

Discounts and Promotions

Both Costco Car Insurance and Direct Online Insurers often have discounts and promotions that can affect affordability for UK consumers. These discounts may include safe driver discounts, multi-policy discounts, loyalty discounts, and more. It's essential for consumers to compare these offers to determine which option provides the best value for their specific needs.

Customer Service and Claims Process

When it comes to car insurance, having reliable customer service and an efficient claims process is essential for UK consumers. Let's evaluate the customer service reputation of Costco Car Insurance versus Direct Online Insurers and detail the claims process for each provider to see which one offers a better experience for customers.

Customer Service Reputation

- Costco Car Insurance is known for its excellent customer service, with many customers praising the helpfulness and efficiency of their representatives.

- Direct Online Insurers also receive positive feedback for their customer service, often offering 24/7 support through online chat or phone.

- Customer reviews for both providers highlight the ease of reaching customer service representatives and the quick resolution of queries.

Claims Process Efficiency

- Costco Car Insurance has a straightforward claims process, with customers reporting quick approval and payout times for their claims.

- Direct Online Insurers also streamline their claims process, allowing customers to submit claims online and track the progress easily.

- Comparing the efficiency of claims processing between the two, both providers seem to offer a hassle-free experience for customers.

Customer Reviews

- Customers who have interacted with Costco Car Insurance's customer service team have praised their professionalism and responsiveness.

- Direct Online Insurers' customers appreciate the convenience of being able to manage their claims online and the prompt assistance provided by their support team.

- Overall, customer reviews indicate that both Costco Car Insurance and Direct Online Insurers prioritize customer satisfaction and aim to make the claims process as smooth as possible.

Accessibility and Convenience

When it comes to choosing between Costco Car Insurance and Direct Online Insurers in the UK, accessibility and convenience play a crucial role in the overall customer experience. Let's delve into how these providers stack up in terms of providing easy access to their services and offering convenient ways to manage policies, make claims, and seek support.

Accessibility of Services

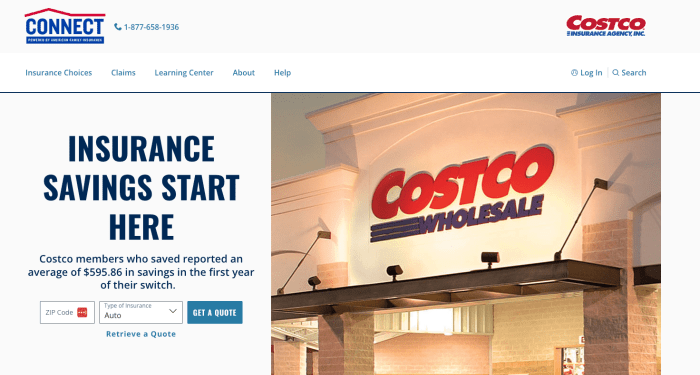

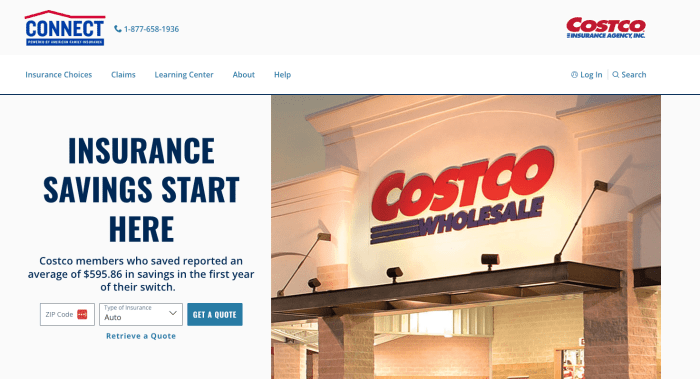

- Costco Car Insurance: As a membership-based retailer, Costco Car Insurance offers its services to Costco members, making it accessible to a specific group of consumers. While this exclusivity may limit access to some individuals, Costco members can easily access their insurance services through the Costco website or by contacting their customer support.

- Direct Online Insurers: Direct Online Insurers, on the other hand, are open to all consumers and can be accessed by anyone with an internet connection. This broad accessibility ensures that a wide range of individuals can benefit from their insurance offerings without any membership requirements.

Convenience in Managing Policies and Making Claims

- Costco Car Insurance: Costco Car Insurance provides a user-friendly online platform where policyholders can easily manage their policies, make premium payments, and access policy documents. However, the process of making claims may involve contacting customer support, which could be perceived as less convenient compared to online claim submissions.

- Direct Online Insurers: Direct Online Insurers typically offer a seamless online portal where customers can manage their policies, make claims, upload documents, and track the status of their claims. This streamlined process enhances convenience for policyholders, allowing them to handle insurance-related tasks efficiently.

Online Tools and Mobile Apps

- Costco Car Insurance: While Costco Car Insurance may not offer a dedicated mobile app, their website is optimized for mobile devices, providing on-the-go access to policy information and customer support. However, the absence of a mobile app could be seen as a limitation in terms of convenience for some tech-savvy consumers.

- Direct Online Insurers: Direct Online Insurers often provide mobile apps that enable customers to manage their policies, file claims, communicate with support representatives, and receive updates in real-time. These apps enhance convenience by offering a comprehensive suite of tools at policyholders' fingertips.

Conclusion

In conclusion, the comparison between Costco Car Insurance and Direct Online Insurers sheds light on the different aspects that UK consumers need to consider. From coverage options to cost and customer service, this discussion aims to help consumers make informed decisions.

Answers to Common Questions

Which factors should UK consumers consider when choosing between Costco Car Insurance and Direct Online Insurers?

UK consumers should consider coverage options, cost differences, customer service reputation, and accessibility of services provided by each insurer.

Are there any specific discounts offered by Costco Car Insurance or Direct Online Insurers for UK consumers?

Both insurers may offer discounts based on factors like driving history, vehicle type, or bundling policies. It's advisable to inquire directly with each provider for specific details.