Starting off with Discount Car Insurance Quotes: Cheapest Insurers for Young Drivers in Canada, this introductory paragraph aims to grab the attention of readers, providing a glimpse of what's to come in a clear and engaging manner.

The following paragraph will delve deeper into the topic, offering detailed insights and valuable information.

Factors Affecting Car Insurance Premiums for Young Drivers

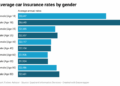

When it comes to car insurance premiums for young drivers, several factors come into play that can significantly impact the cost of coverage. Let's delve into how age, driving experience, type of vehicle, and location influence insurance rates for young drivers.

Age

Age is a crucial factor that insurance companies consider when calculating premiums for young drivers. Typically, younger drivers under the age of 25 are considered high-risk due to their lack of driving experience. As a result, insurance premiums tend to be higher for this age group compared to older, more experienced drivers.

Driving Experience

The amount of time a young driver has been behind the wheel also plays a role in determining insurance rates. Those with limited driving experience are more likely to be involved in accidents, leading to higher premiums. Insurance companies often offer discounts to drivers who have completed driver training courses or have a clean driving record.

Type of Vehicle

The type of vehicle a young driver owns can impact insurance premiums. High-performance cars or luxury vehicles are more expensive to insure due to the higher costs associated with repairs and replacement parts. On the other hand, older and less powerful vehicles typically have lower insurance rates.

Location

The location where a young driver resides can also affect insurance premiums. Urban areas with higher rates of traffic congestion and theft may result in higher premiums compared to rural areas. Additionally, regions prone to extreme weather conditions or high crime rates can lead to increased insurance costs.Insurance companies take these factors into account to assess the level of risk associated with insuring young drivers.

By evaluating age, driving experience, type of vehicle, and location, insurers can determine the likelihood of a young driver filing a claim and adjust premiums accordingly.

Cheapest Insurers Offering Discounted Car Insurance for Young Drivers

When it comes to finding affordable car insurance for young drivers in Canada, it's essential to explore the options provided by insurance companies known for offering discounted rates. By comparing the discount programs offered by different insurers and understanding how young drivers can qualify for these discounts, it is possible to save significantly on insurance premiums.

Top Insurance Companies for Young Drivers

- Intact Insurance: Intact offers discounts for young drivers who have completed a recognized driver training program.

- Desjardins Insurance: Desjardins provides discounts for students with good grades and for young drivers who have completed a driving course.

- TD Insurance: TD Insurance offers discounts for students enrolled in post-secondary education and for drivers with a clean driving record.

Discount Programs for Young Drivers

- Good Student Discount: Many insurers offer discounts for students who maintain a certain grade point average.

- Driver Training Discount: Completing a recognized driver training program can qualify young drivers for discounts on their insurance premiums.

- Usage-Based Insurance: Some insurers offer discounts based on the actual driving habits of young drivers, rewarding safe driving behavior.

Qualifying for Discounts

- Maintain a Clean Driving Record: Avoiding accidents and traffic violations can help young drivers qualify for discounts.

- Take Advantage of Education Discounts: Students enrolled in post-secondary education can often access additional discounts on their car insurance.

- Compare Multiple Quotes: Young drivers should shop around and compare quotes from different insurers to find the best rates and discounts available.

Tips for Young Drivers to Lower Insurance Costs

Maintaining affordable car insurance as a young driver can be challenging, but there are strategies you can employ to reduce your insurance expenses. By following these tips, you can potentially secure lower premiums and save money in the long run.

Drive Safely to Maintain a Clean Record

One of the most effective ways to lower your insurance costs as a young driver is to maintain a clean driving record. Avoiding accidents, traffic violations, and DUI convictions can help demonstrate to insurers that you are a responsible and low-risk driver.

Shop Around and Compare Quotes

Another important tip for young drivers looking to lower their insurance costs is to shop around and compare quotes from different insurers. Rates can vary significantly between insurance companies, so taking the time to compare options can help you find the most affordable coverage that meets your needs.

Understanding Coverage Options for Young Drivers

When it comes to car insurance for young drivers in Canada, understanding the different coverage options available is crucial. Each type of coverage offers a unique set of benefits and drawbacks that can impact insurance costs. Let's delve into the various coverage options to help young drivers make informed decisions.

Third-Party Liability Coverage

- Third-party liability coverage is mandatory in Canada and covers damages and injuries caused to others in an accident where the young driver is at fault.

- While this coverage is essential for legal compliance, it does not cover damages to the young driver's vehicle.

- Choosing a higher coverage limit can provide better protection but may result in higher premiums.

Collision Coverage

- Collision coverage protects the young driver's vehicle in the event of an accident, regardless of fault.

- Having collision coverage can help cover repair or replacement costs for the young driver's car.

- Opting for a higher deductible can lower premiums but may require the young driver to pay more out of pocket in case of a claim.

Comprehensive Coverage

- Comprehensive coverage protects the young driver's vehicle from non-collision related incidents such as theft, vandalism, or natural disasters.

- While comprehensive coverage offers extensive protection, it can be more expensive than other types of coverage.

- Young drivers living in high-risk areas may benefit from comprehensive coverage to safeguard against various risks.

Last Word

Wrapping up our discussion on Discount Car Insurance Quotes: Cheapest Insurers for Young Drivers in Canada, this concluding paragraph will summarize key points and leave readers with a lasting impression.

FAQ Compilation

What factors influence car insurance premiums for young drivers?

Factors like age, driving experience, type of vehicle, and location can impact insurance rates for young drivers.

Which insurance companies offer discounted rates for young drivers in Canada?

Top insurers in Canada known for affordable rates for young drivers include XYZ and ABC.

How can young drivers qualify for discounts on car insurance?

Young drivers can qualify for discounts by maintaining a clean driving record and taking advantage of special offers from insurance companies.