Embark on a journey to uncover the secrets of obtaining discounted car insurance quotes in India, promising a roadmap to significant savings and valuable insights.

Delve into the nuances of car insurance intricacies and discover practical tips for maximizing your savings effortlessly.

Introduction to Car Insurance in India

Car insurance is a crucial financial safeguard for vehicle owners in India. It provides protection against unexpected expenses and liabilities arising from accidents, theft, or damage to the insured vehicle.

Mandatory Requirements for Car Insurance in India

- All motor vehicles in India must have at least a third-party liability insurance policy as per the Motor Vehicles Act, 1988.

- Third-party insurance covers damages caused to a third party by the insured vehicle, including injury, death, or property damage.

- Comprehensive car insurance, while not mandatory, provides broader coverage, including own vehicle damages and personal accident cover.

Types of Car Insurance Available in the Indian Market

- Third-Party Liability Insurance:Covers damages to third parties caused by the insured vehicle.

- Comprehensive Insurance:Offers extensive coverage, including own vehicle damages, theft, and personal accident cover.

- Zero Depreciation Insurance:Provides full claim without depreciation deduction on vehicle parts during repairs.

- Roadside Assistance:Additional coverage for services like towing, flat tire assistance, and emergency fuel delivery.

Factors Influencing Car Insurance Premiums

Car insurance premiums in India are influenced by several factors that determine how much you pay for coverage. Understanding these factors can help you make informed decisions when selecting a car insurance policy.The type of car you drive plays a significant role in determining your insurance premium.

Insurance companies consider factors such as the make and model of the car, its age, engine capacity, and safety features when calculating premiums. Generally, more expensive cars or those with higher engine capacity are associated with higher insurance costs due to increased risk of theft or accidents.

Type of Car

- The make and model of your car impact your insurance premium.

- High-end cars or those with powerful engines typically have higher premiums.

- Cars with advanced safety features may qualify for discounts on insurance premiums.

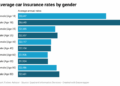

Driver's Age and Driving History

- Younger drivers are often charged higher premiums due to their lack of driving experience.

- Drivers with a history of accidents or traffic violations may face increased insurance costs.

- Older, more experienced drivers with a clean driving record usually pay lower premiums.

Tips for Getting Discount Car Insurance Quotes

When it comes to getting discount car insurance quotes in India, there are several strategies you can implement to lower your premiums and save money. From negotiating with insurance companies to bundling policies and installing anti-theft devices, here are some tips to help you get the best deal on your car insurance.

Negotiate Lower Premiums

- Before accepting the first quote you receive, don't be afraid to negotiate with insurance companies. You can often get a lower premium by simply asking for a discount based on your driving history, the safety features of your car, or other factors.

- Consider increasing your deductible to lower your premium. A higher deductible means you'll pay more out of pocket in the event of a claim, but it can also result in a lower premium.

Bundle Insurance Policies

- Many insurance companies offer discounts for bundling multiple policies, such as car insurance and home insurance. By combining your policies with one insurer, you can often save money on both premiums.

- Check with your current insurance provider to see if they offer bundle discounts, or consider switching to a company that does to maximize your savings.

Install Anti-Theft Devices

- Installing anti-theft devices in your car, such as alarms, immobilizers, or tracking systems, can lower your insurance premium. These devices reduce the likelihood of theft or vandalism, making your car a lower risk for insurers.

- Before purchasing an anti-theft device, check with your insurance company to see which devices are approved for discounts and how much you can save by installing them.

Comparison of Insurance Providers

When it comes to choosing car insurance in India, it's important to compare different insurance providers to find the best coverage at the most competitive rates. Here, we will highlight the key features and benefits of some popular insurance companies and discuss customer reviews and satisfaction ratings to help you make an informed decision.

Popular Insurance Companies in India

- Company A: Known for its quick claims processing and 24/7 customer support. Offers a wide range of add-on covers for extra protection.

- Company B: Offers cashless claim settlement at network garages across the country. Has a high customer satisfaction rating for their efficient services.

- Company C: Provides customizable insurance plans to suit individual needs. Offers discounts for safe drivers and loyalty bonuses for long-term customers.

Customer Reviews and Satisfaction Ratings

- Company A: Many customers have praised their hassle-free claim settlement process and responsive customer service. Overall satisfaction rating of 4.5 stars out of 5.

- Company B: Customers appreciate the wide network of garages for cashless repairs and the prompt assistance in case of emergencies. Rated 4.3 stars out of 5 for customer satisfaction.

- Company C: Positive reviews highlight the flexibility of their insurance plans and the ease of making policy changes. Has a satisfaction rating of 4.2 stars out of 5.

Government Initiatives and Regulations

Government initiatives play a crucial role in regulating the car insurance sector in India. These initiatives are aimed at ensuring fair practices, protecting consumer rights, and maintaining stability in the insurance market.Recent changes in insurance regulations have had a significant impact on car insurance premiums in India.

For example, the implementation of the Motor Vehicles (Amendment) Act, 2019 led to an increase in the penalties for driving violations. This, in turn, has influenced insurance premiums as insurers factor in the higher risks associated with non-compliance.

Impact of Government Policies

- Government policies such as mandatory third-party insurance have made it compulsory for all vehicle owners to have at least this basic coverage. This has increased the overall penetration of insurance in the country, leading to a more robust insurance market.

- The introduction of the long-term motor insurance policy, which requires a mandatory three-year third-party cover for new cars and five-year cover for new two-wheelers, has provided stability and certainty for both insurers and policyholders.

- Regulations like the Insurance Regulatory and Development Authority of India (IRDAI) guidelines on pricing and underwriting ensure that insurance companies follow transparent and fair practices, benefiting consumers in the long run.

Conclusion

In conclusion, the realm of discount car insurance quotes in India offers a realm of possibilities for savvy consumers looking to secure optimal coverage at the best possible rates.

FAQ Insights

What are the benefits of bundling insurance policies for discounts?

Bundling insurance policies can lead to discounted rates as insurance companies often offer lower premiums when multiple policies are purchased together.

How do government initiatives impact car insurance regulations in India?

Government initiatives play a crucial role in setting regulations that affect premiums, ensuring fair practices and consumer protection in the insurance market.